total property tax in frisco tx

The median property tax in Texas is 227500 per year for a home worth the median value of 12580000. The median property tax in Collin County Texas is 4351 per year for a home worth the median value of 199000.

How Taxes In Texas Compare To Other States Guide To Texas Property Tax Comparison Tax Ease

Capped properties market value increases may not exceed 10 per year.

. 2020 rates included for use while preparing your income tax deduction. Counties in Texas collect an average of 181 of a propertys assesed fair market value as property tax per year. Texass median income is 62353 per year so the.

Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. The 2021 adopted tax rate for Frisco ISD is 12672. The average lot size on Norfolk Ln is 81893 ft2 and the average property tax is 78Kyr.

The average property on Shady Oaks Dr was built in 2005 with an average home value of 1094642. Taxes in Ruidoso New Mexico are 276 cheaper than Frisco Texas. Tax Code Section 1113 b requires school districts to provide a 40000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to adopt a local option residence homestead exemption of up to 20 percent of a propertys appraised value.

A Frisco Property Records Search locates real estate documents related to property in Frisco Texas. The latest sales tax rate for Frisco TX. Collin County Tax Assessor Collector Office.

One important factor in home affordability in Frisco Texas is your Frisco Texas property taxes. Under Texas Tax Code Section 2518 reassessments must be undertaken at least once every three years. Thus its mainly all about budgeting first setting an annual expenditure total.

6101 Frisco Square Boulevard. The average lot size on Shady Oaks Dr is 25227 ft2 and the average property tax is 238Kyr. See Property Records Tax Titles Owner Info More.

Collin County Tax Assessor-Collector Frisco Office 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034. Search Any Address 2. The Frisco City Council approved a measure on June 21 2022 to increase the homestead tax exemption for homeowners and the property tax freeze for elderly and disabled residents.

Single family home located at 15788 Foliage Rd Frisco TX 75035 on sale now for 900000. Property taxes are local taxes. TX Rates Calculator Table.

Frisco as well as every other in-county public taxing unit can at this point compute required tax rates since market value totals have been recorded. Plano Texas and Frisco Texas. Several government offices in Frisco and Texas.

Collin County has one of the highest median property taxes in the United States and is ranked 48th of the 3143 counties in order of median property taxes. Below 100 means cheaper than the US average. Public Property Records provide information on land homes and commercial properties in Frisco including titles property deeds mortgages property tax assessment records and other documents.

That represents a 44 percent increase since 2013 when the average homeowners city property tax bill was 1278 and the average home valued at 276592. 423 Frisco TX 75034. 35 properties and 35 addresses found on Shady Oaks Drive in Frisco TX.

Texas has one of the highest average property tax rates in the country with only thirteen states levying higher property taxes. Typically a sweeping appraisal strategy is employed with that same methodology applied en masse to similar property types. Interest Sinking Fund.

The combined tax rate is a combination of an MO tax rate of 09972 and an IS tax rate of 027. The ad valorem property tax is levied Oct. When added together the property tax load all owners support is established.

Denton County Tax Collector - Frisco Office Contact Information. Assumes a new 25000 Honda Accord and Sales Tax is amortized over 6 years. About our Cost of Living Index.

This is driven largely by the high rates used to fund local school districts. 1 of each year on the assessed value listed as of the prior Jan. Be Your Own Property Detective.

1 for all real and business personal property located in the city. Address Phone Number and Hours for Denton County Tax Collector - Frisco Office a Treasurer Tax Collector Office at Farm to Market Road 423 Frisco TX. The local option exemption cannot be less than 5000.

The tax rates are stated at a rate per 100 of assessed value. Frisco City Council intends to keep the citys current property tax rate of 04466 per 100 valuation steady for the upcoming 2020-21 fiscal year. City of Frisco Total.

Name Denton County Tax Collector - Frisco Office Address 5533 Farm to Market Road 423 Frisco Texas 75034 Phone 940-349-3510. Collin County Tax Assessor-Collector Frisco Office. Frisco TX Sales Tax Rate.

This rate includes any state county city and local sales taxes. Monday - Friday 8 am. Collin County collects on average 219 of a propertys assessed fair market value as property tax.

The December 2020. At the citys proposed rate the average Frisco homeowner will pay 1845 in city property taxes on a home valued at 413028 up about 2 percent from last year. Learn about Frisco Texas property taxes from Frisco Top Realtor and Frisco Luxury Home Realtor Real Estate Agent - What is my Frisco home worth.

Above 100 means more expensive. View 27 photos of this 4 bed 4 bath 3238 sqft. Here is some information about the current Frisco property taxes.

100 US Average. Frisco Code Enforcement 6101 Frisco Square Boulevard Frisco TX 75034 972-292-5302 Directions. Search For Title Tax Pre-Foreclosure Info Today.

Select an address below to learn more about the property such as who lives and. The current total local sales tax rate in Frisco TX is 8250. Purefoy Municipal Center Frisco City Hall 6101 Frisco Square Blvd Suite 2000 Frisco TX 75034 Map.

All Frisco ISD taxes are collected by the Collin County Tax Office. 2022 Cost of Living Calculator for Taxes. A satellite office is located in Frisco Government Center at 5535 FM.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Should you have any questions please contact The Frisco.

Budget And Tax Facts City Of Lewisville Tx

Beautiful Corner Lot Property In The Sought After Frisco Isd This Home Boasts 4 Beds 3 Baths And 2 Car Garage The Ki New Home Construction Home Buying Home

What Is The Property Tax Rate In Frisco Texas

What Is The Property Tax Rate In Coppell Texas

Budget And Tax Facts City Of Lewisville Tx

Beautiful Frisco Home Video Home Texas Homes House Styles

What Is The Property Tax Rate In Frisco Texas

Garage Door Repair Solutions Chicago Offering A Garage Door Opener Installation And Repair Service Send2press Newswire Door Repair Garage Door Repair Commercial Loans

What Is The Property Tax Rate In Frisco Texas

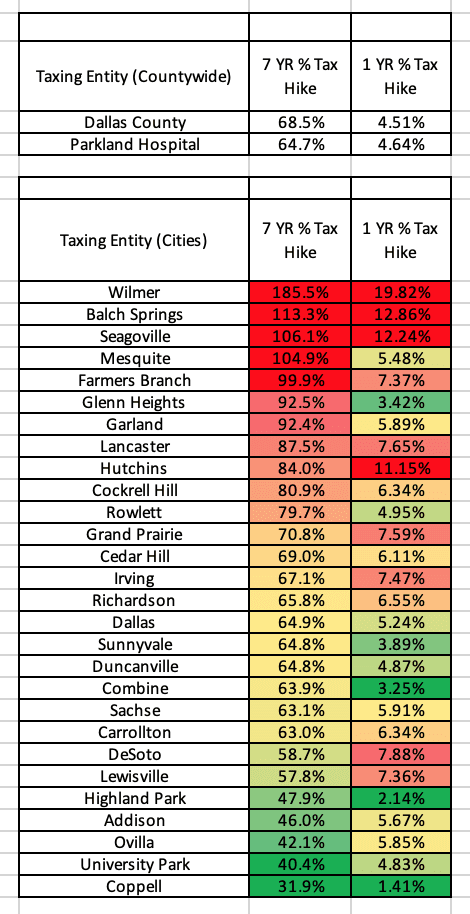

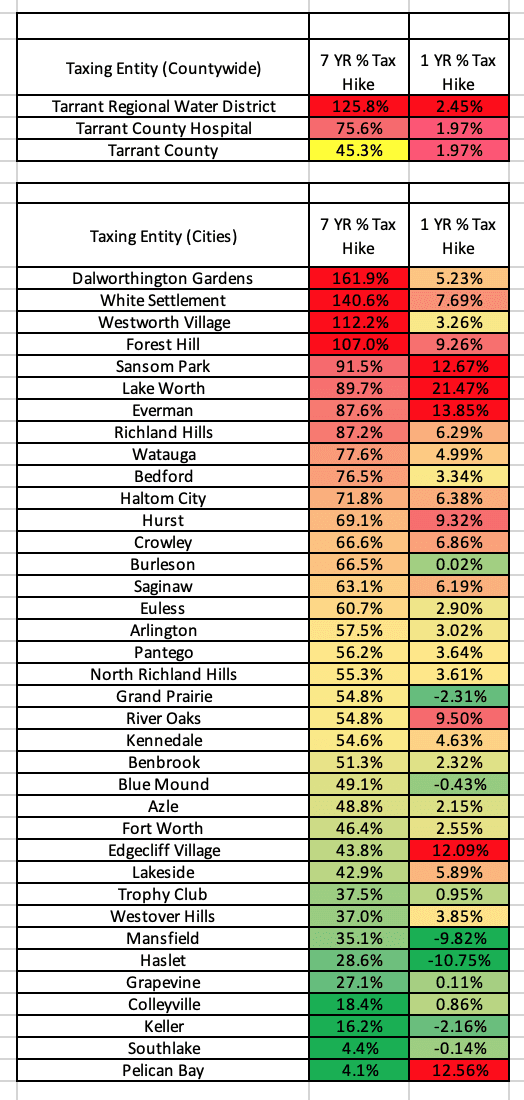

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Pin On Real Estate First Time Home Buyer Programs Texas

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

/cloudfront-us-east-1.images.arcpublishing.com/dmn/LC7FGEONRM65LQRKC2MPUJREWU.jpg)

Property Tax Alert What Does Land Value Mean For Your Taxes Watchdog Curious Texas Can Tell You

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Buying Or Selling Celina Tx Real Estate The Timing Couldn T Be Bette Property Tax Real Estate Dallas Real Estate